The American Surveyor

Latest News

04.18.2024

Common Ground Alliance Hosts Conference & Expo in Colorado on Preventing Utility Damages

04.18.2024

Virtual Surveyor Adds Planimetric Survey Functionality to Latest Release of Smart Drone Surveying Software

04.17.2024

7 Things to See at GEO Business

04.15.2024

In Passing: Dale Beeks (1951 – 2023)

04.15.2024

Point One Delivers the First Highly Accurate and Easy-to-Use Precision Platform for Surveyors and Surveying Tool Manufacturers

04.11.2024

Strategic Agreements Integrate Topcon Technology Into Solutions from Bentley Systems and Worldsensing

04.08.2024

Space Flight Laboratory Confirms Successful Deployment of HawkEye 360 Microsatellite Clusters 8 and 9

04.08.2024

Septentrio mosaic GPS/GNSS Now Also Available in MIKROE Click Board Ecosystem

04.08.2024

INTERGEO: Meeting Place for the Global Geospatial Community

04.05.2024

Live Workshop: Obliques for Mapping: Are They Really Useful?

04.02.2024

Avineon Completes Acquisition of North Point Geographic Solutions

03.29.2024

ABC: Final OSHA Worker Walkaround Rule Is Bad Policy, Does Not Prioritize Workplace Safety

03.29.2024

Hancock Associates Announces Retirement of John Noonan, P.E., P.L.S.

03.28.2024

Survey Reveals 26.9 Million Americans Plan to Dig Without Contacting 811 First

03.28.2024

ABC Files Lawsuit Against President Biden’s Anti-Competitive Project Labor Agreement Rule for Federal Construction Projects

03.27.2024

Commercial UAV Expo Announces 2024 Advisory Board

03.26.2024

Geneq Unveils the SXblue GLOBE

03.19.2024

Emlid Celebrates its 10th Anniversary

03.18.2024

Trimble and Radiodetection Combine Survey-Grade Positioning with Underground Utilities Locating Measurement Workflows

03.18.2024

SimActive Used to Control Accuracy Through Different Types of GCPs

03.13.2024

GCPs for Photogrammetry: How Many Do You Need?

03.13.2024

Resolution in Congress Seeks to Preserve Licensure of Design Professionals in Architecture, Engineer, and Surveying

03.13.2024

UP42 and Geoawesomeness Unveil 2024 Report on the Adoption of Earth Observation

Features

Latest Issue

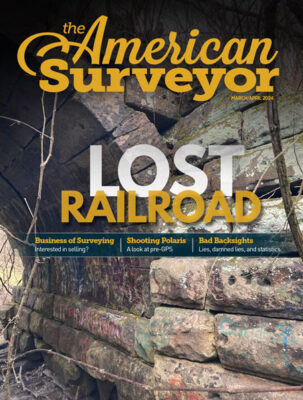

Volume 21 Issue 1 // March 2024

Departments

The Business of Surveying

The Business of Surveying: There’s a New Buyer in Town—Are You Ready?

This article kicks off a new series, Business of Surveying, by Rich Radke, a seasoned business advisor with expertise in advising companies across…

Guest Editorial

Guest Editorial: Don’t Be a Button Pusher

“Hey! My best friend’s uncle’s neighbor’s brother-in-law was a surveyor!” Any surveyor who has spent any time in the field has heard a…

Bad Backsights

Bad Backsights: Spring Interrogatory

There are always more questions than answers. This seems to be a universal law and it certainly holds true in my experience. Every…

Vantage Point

Vantage Point: Read the Deed!

When my husband and I sat down to sign closing papers to buy our current house, I asked to see the deed before…

The Business of Surveying

The Business of Surveying: There’s a New Buyer in Town—Are You Ready?

This article kicks off a new series, Business of Surveying, by Rich Radke, a seasoned business advisor with expertise in advising companies across…

Guest Editorial

Guest Editorial: Don’t Be a Button Pusher

“Hey! My best friend’s uncle’s neighbor’s brother-in-law was a surveyor!” Any surveyor who has spent any time in the field has heard a…

Bad Backsights

Bad Backsights: Spring Interrogatory

There are always more questions than answers. This seems to be a universal law and it certainly holds true in my experience. Every…

Vantage Point

Vantage Point: Read the Deed!

When my husband and I sat down to sign closing papers to buy our current house, I asked to see the deed before…